Today is St. Joseph’s Day, a celebration of the husband of the virgin Mary and step father of Jesus.

Joseph was a carpenter and also the patron saint of home and family in the Roman Catholic religion, which is presumed to be the reason he is now connected with real estate.

Prayer To St. Joseph to Sell House

O, Saint Joseph,

you who taught our Lord

the carpenter’s trade,

and saw to it

that he was always properly housed,

hear my earnest plea.I want you to help me now

as you helped your foster-child Jesus,

and as you have helped many others

in the matter of housing.I wish to sell this [house/property]

quickly, easily, and profitably

and I implore you to grant my wish

by bringing me a good buyer,

one who is

eager, compliant, and honest,

and by letting nothing impede the

rapid conclusion of the sale.Dear Saint Joseph,

I know you would do this for me

out of the goodness of your heart

and in your own good time,

but my need is very great now

and so I must make you hurry

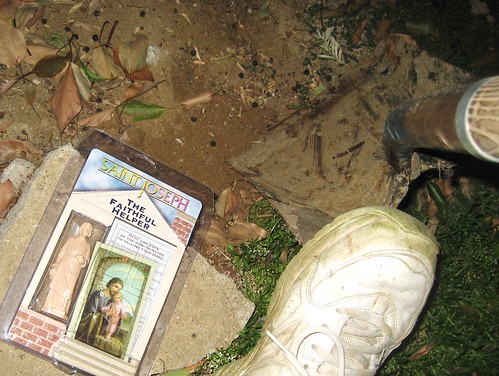

on my behalf.Saint Joseph, I am going to place you

in a difficult position

with your head in darkness

and you will suffer as our Lord suffered,

until this [house/property] is sold.Then, Saint Joseph, i swear

before the cross and God Almighty,

that i will redeem you

and you will receive my gratitude

and a place of honour in my home.Amen.

Many sources, however, state that the homeowner can simply make an earnest and heartfelt plea to the Saint in their own words. There are a lot of options in purchasing a statue of St. Joseph online. I did a quick search on Amazon and found very affordable options.

Now, I am not Catholic myself, but for about $5, I would be willing to give this a try! Have you done this? How did it work for you?