The real estate market in Western Massachusetts has experienced notable trends and characteristics in recent years. As an expansive region encompassing counties such as Berkshire, Franklin, Hampden, and Hampshire, Western Massachusetts offers a diverse landscape and a mix of rural, suburban, and urban areas. Here’s a description of the real estate market in the region:

- Steady Demand: The demand for real estate in Western Massachusetts has remained relatively stable. Many homebuyers are attracted to the region’s natural beauty, charming small towns, and access to outdoor recreational activities. The market has seen a consistent interest from local residents as well as individuals from nearby states seeking a more affordable living alternative to larger metropolitan areas.

- Affordability: Compared to more expensive areas in the state, such as the Greater Boston area, Western Massachusetts offers relatively affordable housing options. This affordability factor has attracted buyers who seek reasonably priced homes or investment properties. Additionally, the cost of living in the region tends to be lower, making it an attractive destination for individuals looking to relocate.

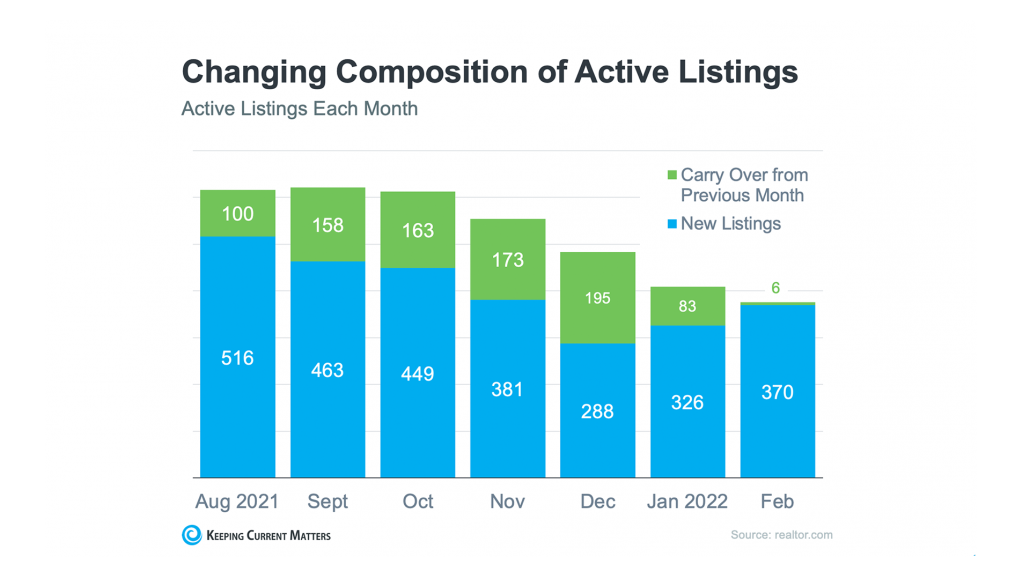

- Varied Inventory: The real estate market in Western Massachusetts features a diverse inventory of properties. You can find a range of options, including single-family homes, historic houses, apartments, condos, and even larger estates in some areas. From picturesque rural settings to vibrant downtown neighborhoods, there is a variety of choices to suit different preferences and budgets.

- Strong Tourism Market: Western Massachusetts is known for its scenic landscapes, cultural attractions, and historic sites. Popular destinations like the Berkshires, Tanglewood (summer home of the Boston Symphony Orchestra), and the town of Northampton attract visitors from across the region and beyond. This vibrant tourism market contributes to the overall strength of the real estate sector, particularly in areas with high visitor traffic.

- University Influence: The presence of several prominent colleges and universities in Western Massachusetts, such as UMass Amherst, Smith College, and Williams College, contributes to the region’s real estate market. These educational institutions draw students, faculty, and staff, creating a demand for rental properties and often leading to stable rental markets in college towns.

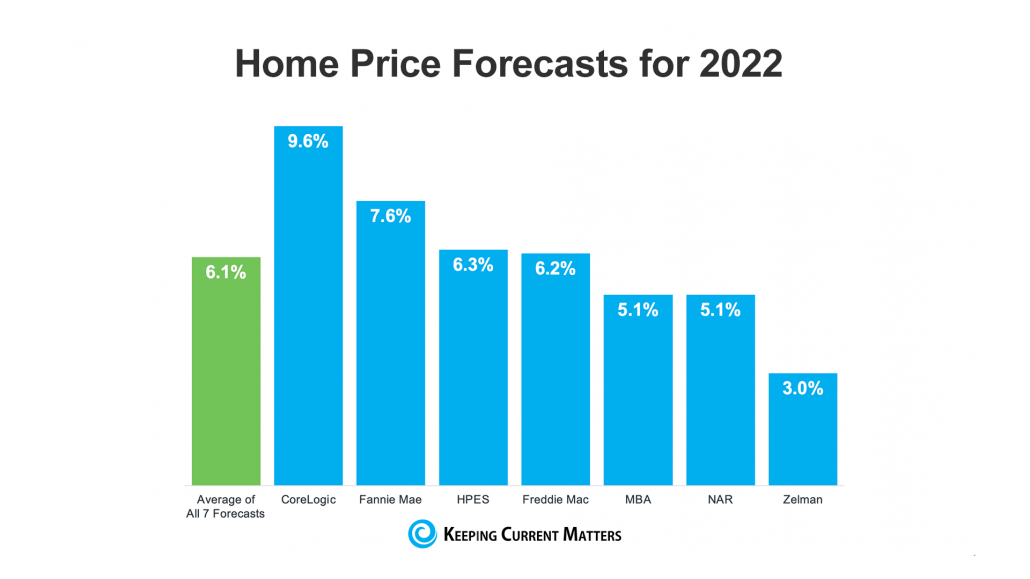

- Seller’s Market Conditions: Like many parts of the country, Western Massachusetts has experienced a seller’s market in recent years. This means that the demand for homes exceeds the available supply, resulting in rising home prices and a competitive buying environment. Multiple-offer situations and quicker sales are common in this market, particularly for desirable properties in sought-after neighborhoods.

It’s important to note that real estate markets can vary across different towns and cities within Western Massachusetts. Local factors, such as job growth, economic development, and specific community dynamics, can influence the market conditions in individual areas. If you are considering buying or selling a property in Western Massachusetts, it’s advisable to consult with a local real estate professional who can provide up-to-date information and tailored insights based on your specific needs.

LESLEY LAMBERT, WESTERN MA REALTOR WITH PARK SQUARE REALTY 413-575-3611